We've been

waiting (and

waiting...) for the new version of Quicken for the Mac. In the meantime, the folks at Intuit have been plugging

Quicken Online as "a great way to get started", and as an alternative solution for those who can't wait for the next desktop version of Quicken for the Mac. And hey, it's free! I've taken a look at Quicken Online for a while now, and while there are certainly some neat features in Quicken Online, there are also some glaring omissions.

Quicken Online is designed to automatically download transaction information from your bank's online access. Setting up your accounts is straightforward -- you provide your financial institution and your login details, and Quicken Online finds the available accounts (checking, savings) and downloads the last 90 days worth of transactions.

What's Good

Automatic Categorization of Transactions

One of the neat features that Quicken Online does is it automatically tries to assign a category to each of your transactions. When I set it up with my checking account, it correctly guessed that Safeway transactions should be assigned to the Groceries category, that the AT&T bill should go into Utilities, and that Starbucks should be dining. There were transactions that it couldn't categorize, and it was fairly straightforward to assign a category. As you continue to use Quicken Online, it learns about the categories that you assign to transactions, so it can use the same category in the future.

Quicken Online comes with a starter set of categories:

You can add categories and rename the ones from the starter set. For example, the starter set has a category called "Childcare/Daycare", which I renamed "Daycare". I also added a category called "Cell Phone". User-defined categories are in blue.

Automatic Detection of Recurring Transactions

Another neat feature of Quicken Online is that, when it loads up the last 90 days worth of transactions, it examines them for recurring transactions, putting them in a section called "Upcoming Transactions". I found that it made mostly sensible entries into this list, including things like utility bills and my mortgage, but excluding transactions that repeat irregularly, like groceries and dining out. There were a couple of things it got wrong (for example, I have some bills that come once every 2 or 3 months, but it guessed that they were monthly).

Basic Tracking of Expenses

In addition to downloading transactions from your financial institution, Quicken Online allows you to enter transactions on your own. This is, of course, important, since you need to deduct that amount from the available balance in your account if you're going to avoid overdrafts. Quicken Online also has reminders for your upcoming transactions.

Quicken Online comes with a "Trends" section, allowing you to see how well your income and your expenses match up across different time periods (one month, three months, etc.). It also has a "Goals" section, where you can establish budgetary goals for different categories and track how closely your actual expenditures for the month.

What's Missing

Customization of Categories Lacking

While you can rename any of the starter set of categories and create categories of your own, there are some issues.

The most glaring omission is the lack of sub-categories. For example, while one of the starter categories is Utilities, there is no way to subdivide that further into types of utilities, like electric, phone, or water. Desktop versions of Quicken have had this ability for many many years. Sub-categories are very useful in grouping like types of categories together. In addition to utilities, typical categories that can get subdivided are Auto (fuel, service, registration) and Taxes (local, state, federal, property).

Also, one odd thing is that you cannot delete any of the starter set of categories. You can rename them, but you cannot delete them, even if you have no intention of ever using them. While most people could use most of the categories, I'm sure that anyone using Quicken Online would be able to find categories that they would just as soon delete.

No Split Transactions

This is possibly the most glaring omission in Quicken Online. I've been using desktop versions of Quicken since the mid-90's, and one of the features they've had for all this time is the ability to split the amount of a transaction into two or more categories. An obvious example in today's world would be going to the grocery store, buying some groceries, using a debit card, and getting $20 cash back. If the total bill came to $120, you'd want to split that into two categories -- $100 for groceries, and $20 for cash. Quicken Online doesn't let you do that. Each transaction is only allowed to have one category.

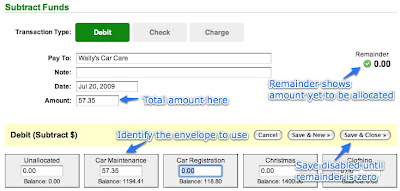

And, of course, the obvious

It probably goes without saying, but Quicken Online doesn't allow you to do our favorite kind of budgeting, envelope budgeting. (

See here about why it's our favorite kind).

Final thoughts

Overall, Quicken Online has some features that are probably a little better than just looking at your account at your financial institution's web site. Being able to enter transactions and predict future expenses is a fundamental part of preventing overdraft. If Quicken Online supported split transactions and sub-categories, it would probably do about 90% of what I would want to be able to do with my desktop Quicken.

A final thought on security

As I mentioned at the top of the post, Quicken Online asks you to enter the login information you use to access your accounts at your financial institution. While Intuit is a corporation that has been around for a while, and they obviously have some security-minded people working for them, when I was handing over this information there was a little voice in the back of my head going "are you sure you want to hand this over?"