If you've been a Quicken user making the transition to Quicken Essentials for Mac you're probably interested in migrating your old data file. Quicken Essentials for Mac comes with a separate application for translating data files, the Quicken File Exchange Utility. Let's see how well this utility works.

Sunday, April 25, 2010

Friday, April 23, 2010

$20 rebate for Quicken Essentials for Mac Early Adopters; Improvements Promised

Intuit has announced today that they are dropping the price for Quicken Essentials for Mac from $69 to $49, and is offering a $20 rebate to those of us who bought the software before April 19, 2010. Go to quicken.com/macrefund to find out the details of this rebate. Act fast -- the rebate period ends on May 31st.

In the same email that announced the rebate, the Quicken team has made promises of updates in the months to come. By the end of April, you'll be able to password-protect your data file and export transaction data to spreadsheets. By August, they're promising that we'll be able to:

In the same email that announced the rebate, the Quicken team has made promises of updates in the months to come. By the end of April, you'll be able to password-protect your data file and export transaction data to spreadsheets. By August, they're promising that we'll be able to:

- Get a complete picture of current net worth by entering investment holdings from brokerages that do not connect to Quicken

- Better understand spending by comparing between different time periods

- Export tax-deductible expenses to tax filing programs like TurboTax

- Track a budget across several months

We welcome these changes, and we'll check 'em out when we get them. (The second bullet point sounds like they're talking about the comparison report, which we noted was missing in action in our post about reports).

Update 4/24/10: Feel free to use this feedback form to tell Intuit what you think about Quicken Essentials for Mac.

Update 4/24/10: Feel free to use this feedback form to tell Intuit what you think about Quicken Essentials for Mac.

Monday, April 5, 2010

Reports in Quicken Essentials for Mac

This is the latest in our series deconstructing Quicken Essentials for Mac.

Quicken Essentials for Mac comes with a significantly reduced set of reports, as compared to previous versions of Quicken. There are essentially three different types of reports:

I've already given my opinion on the spending cloud. Let's focus on the other two reports.

Quicken Essentials for Mac comes with a significantly reduced set of reports, as compared to previous versions of Quicken. There are essentially three different types of reports:

- A monthly summary of transactions

- A category summary report

- A "spending cloud"

I've already given my opinion on the spending cloud. Let's focus on the other two reports.

Wednesday, March 31, 2010

Budgets in Quicken Essentials for Mac

I've written before about how budgeting as done by older versions of Quicken falls somewhere between less than useful and misleading. I knew that Quicken Essentials for Mac wouldn't implement envelope budgeting. So, while I'm dubious about its utility, we're aiming for completeness here, so I figured I should give QEM's budgeting a whirl.

Tuesday, March 30, 2010

Downloading and Matching Transactions

In my first looks, Quicken Essentials for Mac does a good job of downloading transactions and matching those transactions to ones that I've entered myself. There are problems with manual matching and unmatching of transactions.

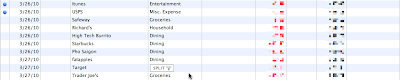

First, a couple of screenshots. Before downloading -- the two top transactions were previously downloaded, and the rest are ones that I entered manually:

After downloading -- blue dots next to the ones that were downloaded and matched. Notice that there's a Safeway transaction that wasn't downloaded; my bank is still listing it as a pending transaction.

The downloading and matching was all accomplished by choosing Update from the Accounts menu (or by using the Update toolbar button), and was fully automated -- no confirmation of matches involved.

Manual Matching and Unmatching

One of the annoyances with older versions of Quicken is that the matching of downloaded transactions would fail:

- I found that it would sometimes mismatch transactions of the same amount -- if I took out $20 in cash, and went to the store and spent $20, it would sometimes swap the two transactions.

- If I had two transactions to the same payee with the same amount, but at different points in time, and only one had cleared, it would match the later transaction instead of the earlier one.

So, I'm naturally distrustful of matching transactions. How do I know it's matched against the right transactions? What if QEM makes a mistake? Can you manually match or unmatch a transaction? Let's take each of these in turn.

Labels:

downloading,

matching,

qem

Scheduled Transactions - Tips and Annoyances

Tips

You have many choices on repeatability:

- Weekly (or every 2, 3, 4, etc. weeks, with a shortcut for 2 and 4 weeks)

- Monthly (or every 2, 3, 4, etc. months, with a shortcut for quarterly)

- Yearly (or every 2, 3, 4, etc. years)

- Twice a month (e.g., the 1st and 15th)

- A special repeatability for estimated taxes (the 15th of January, April, June, and September)

Scheduled transactions can end after a certain number of repetitions, on a certain date, or continue in perpetuity.

Annoyances

One thing that's missing from scheduled transactions that existed in previous versions of Quicken is the ability to indicate whether a scheduled transaction:

- Doesn't vary, and should be automatically entered

- Doesn't vary, but shouldn't be entered automatically

- Varies, and needs reminding a certain number of days in advance.

This annoyance manifests itself in how scheduled transactions actually get entered. As I mentioned in my previous post, upcoming scheduled transactions appear in the appropriate register. When the day for a scheduled transaction comes, however, nothing really happens -- the scheduled transaction is still in the register, and you have to take action to have it get entered.

Specifically, you need to use the "Mark as Paid"/"Mark as Deposited" toolbar button (or action under the Transactions menu). When you do, the transaction is updated, but with the specific amount that you used when you first set up the scheduled transaction (acting like all scheduled transactions should be treated like #2 above). This is annoying, since many of my scheduled transactions do vary.

Specifically, you need to use the "Mark as Paid"/"Mark as Deposited" toolbar button (or action under the Transactions menu). When you do, the transaction is updated, but with the specific amount that you used when you first set up the scheduled transaction (acting like all scheduled transactions should be treated like #2 above). This is annoying, since many of my scheduled transactions do vary.

Labels:

qem,

scheduled_transactions

Getting Started - Scheduled Transactions

When you start from scratch with Quicken Essentials for Mac, the application sets up three tasks for you:

I've covered account setup in a previous post. Let's look at scheduled transactions!

- See Where you Money Goes (setting up accounts)

- Stay on Top of Monthly Bills (scheduled transactions)

- Set Goals to Save Money (budgets)

I've covered account setup in a previous post. Let's look at scheduled transactions!

Labels:

qem,

scheduled_transactions

Subscribe to:

Posts (Atom)