The first thing Quicken gets right that comes to my mind is QuickFill transactions. Next to doing the math for you, QuickFill transactions was one of the first features of Quicken, and it can significantly reduce the drudgery of entering transactions. Reducing this drudgery was key to my early adoption of Quicken in the 90's -- entering transactions was easy enough to do that I wanted to do it. It's very nice being able to type in "saf", and having it fill in "Safeway", with the category of "Groceries" already filled in. Just tab over, enter the amount, and I'm done. Very handy.

There are a couple of improvements that Quicken could do to QuickFill transactions. When I first started using Quicken, it asked me if I wanted to automatically add transactions to my QuickFill list, and I said yes. While that's great for starting out, what it does is it winds up adding every single transaction to your QuickFill list. If you're not careful, you could soon wind up with a QuickFill list that has hundreds of transactions. Worse, since QuickFill searches alphabetically, it's very easy to wind up with some random transaction that winds up coming up first instead of your desired transaction. (I had that problem with "Safeway" when Quicken had memorized "Safest Way Driving School"). Perhaps changing the threshold for adding items to the QuickFill list -- maybe three entries in a month -- would be better.

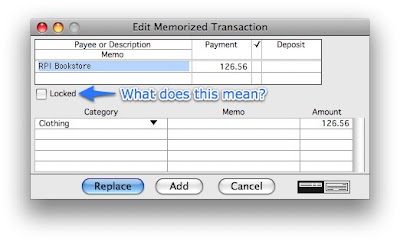

The other improvement that Quicken could do to QuickFill transactions is document what it means for a QuickFill transaction to be locked. When editing a QuickFill transaction, there's a "Locked" checkbox, but it's not at all apparent what it means. Locked QuickFill transactions can still be edited and deleted, and when using a locked QuickFill transaction you can still change the amount and the category. Locking seems fairly useless.

Here's some tips for working with QuickFill transactions:

1. If Quicken has filled in something from your QuickFill list that's very close, but not quite what you want, you can use the up and down arrow keys to cycle through the items on your QuickFill list that match the letters you've typed in so far.

2. If your QuickFill list has gotten cluttered, use Lists > QuickFill Transactions to bring up the list. Use shift-click to select multiple items to delete.

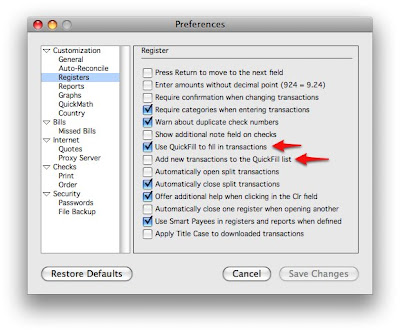

3. To keep Quicken from automatically adding items to your QuickFill list, go to Preferences > Customization > Registers, and unclick the box labelled "Add new transactions to the QuickFill list". You can also turn off QuickFill altogether:

4. If you have "Add new transactions to the QuickFill list" checked, you can keep a new item from getting added to the QuickFill list by holding down the option key when recording the transaction.