1. As I've mentioned before, I use my bank's ability to download transactions for synchronization into Quicken, but my wife and I do all of the data entry into Quicken manually. The bank downloads serve more as a backup for me, for when a receipt gets lost or shoved in the bottom of a bag. That brings me to desired feature #1: On-the-go data entry. It would be handy to be able to make a purchase, start up iPhone Quicken, enter the transaction, and then throw the receipt away. Entries would then get loaded onto the main computer at next sync, or perhaps using 'push' (when that becomes available later this year).

(This was one feature I liked about pre-OS X Quicken, circa 1998 -- they had a desk accessory that allowed for one-off item entry. Lowered barrier to data entry = more frequent data entry = more accurate records).

2. I love my iPhone and keep a close eye on it, but it's small, portable, and easily sold on eBay. If my iPhone is lost or stolen, I shouldn't have to worry that bad people would have access to my bank info. So, desired feature #2: No state secrets on the iPhone. No bank account numbers. You can use the alias for accounts I've got set up (for example, "Our Checking"). A current balance would be okay, but think carefully about transaction history.

3. I'm going to manage my checking account and (maybe) my savings account on the go. Not my mortgage, not my IRA. (I'd include credit cards on this list, but we're a Dave Ramsey household, and so we don't use credit cards). Desired feature #3 is simple but important: Having the ability to select which accounts get synched.

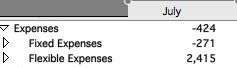

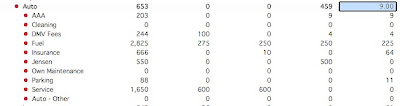

4. In our manifesto we've expressed our desire for envelope-based financial management in Quicken. Here's where an iPhone app could really shine -- support for virtual envelopes. The trouble with doing real envelopes with real cash is that it's a pain (especially when the kids are in the car and you just want to buy gas at the pump). If the current state of envelopes were available on the iPhone, one could make better decisions on the fly.

5. Also in the manifesto I cited one of things that made Quicken a killer app -- Quickfill transactions. I shop at Safeway for groceries, I'm doing data entry, I type in "s-a-f", and boom! it fills in Safeway, fills in the Groceries category. I just type the amount and I'm good to go. Quicken for iPhone should sync up with my Quickfill transactions.

6. This last item should go without saying, but we are talking about the folks who brought us Quicken 2006 for the Mac. A clean, simple interface is a must.

That's my wish list -- what's yours?